Document changes when trading with the United Kingdom from 1 January 2021

Dear valued customers,

As of 1 January 2021, the United Kingdom (UK) will have left the European Union (EU) and the transition period up till Brexit has come to an end. This means that from 1 January 2021, trade in goods with the UK is subject to new customs formalities.

When shipping to the UK, the following is required as of 1 January 2021:

- For Business to Business (B2B) shipments, shippers are required to list the consignee’s UK VAT# for shipments valued below £135, or EORI number for shipments valued above £135.

- Shippers will need to accurately state the value and description of the shipment on the shipment invoice. The description should list the item but should not mention the word samples / not for resale. (e.g. trousers, t-shirt, socks)

- Shippers will need to list the consignee’s company name on the shipment invoice at all times even if the shipment is sent to a residential address. (e.g. ABC trading company, VAT #1234555, Frogmore cottage, 31 Green Lane, UK, John Smith)

- Low value consignment relief, which relieves import VAT on consignments of goods valued at £15 or less, has been abolished. Import VAT will no longer be applied on goods valued at less than £135.

- For Business to Consumer (B2C) shipments, the shipper trading with the UK must register for the UK overseas seller VAT scheme if they are sending shipments to an end-consumer. You are able to register via this link: (https://www.gov.uk/guidance/register-for-vat). The UK VAT# must be listed on the shipment invoice.

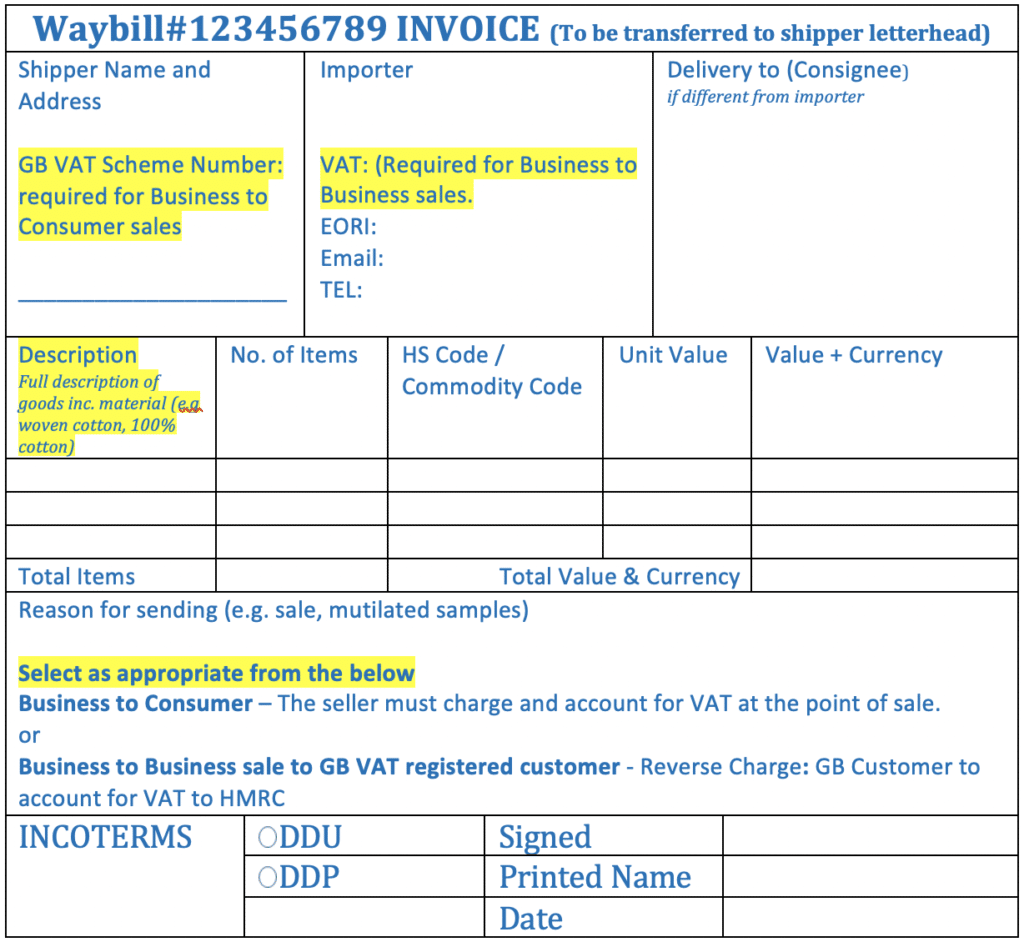

Sample invoice below:

For more information, please visit: https://www.gov.uk/government/publications/changes-to-vat-treatment-of-overseas-goods-sold-to-customers-from-1-january-2021/changes-to-vat-treatment-of-overseas-goods-sold-to-customers-from-1-january-2021.

Failure to comply to these new regulations may result in shipment delays. Should you have any additional questions, please don’t hesitate to contact us.

Royale International